Akhuwat LOan

Apply today Akhuwat Loan

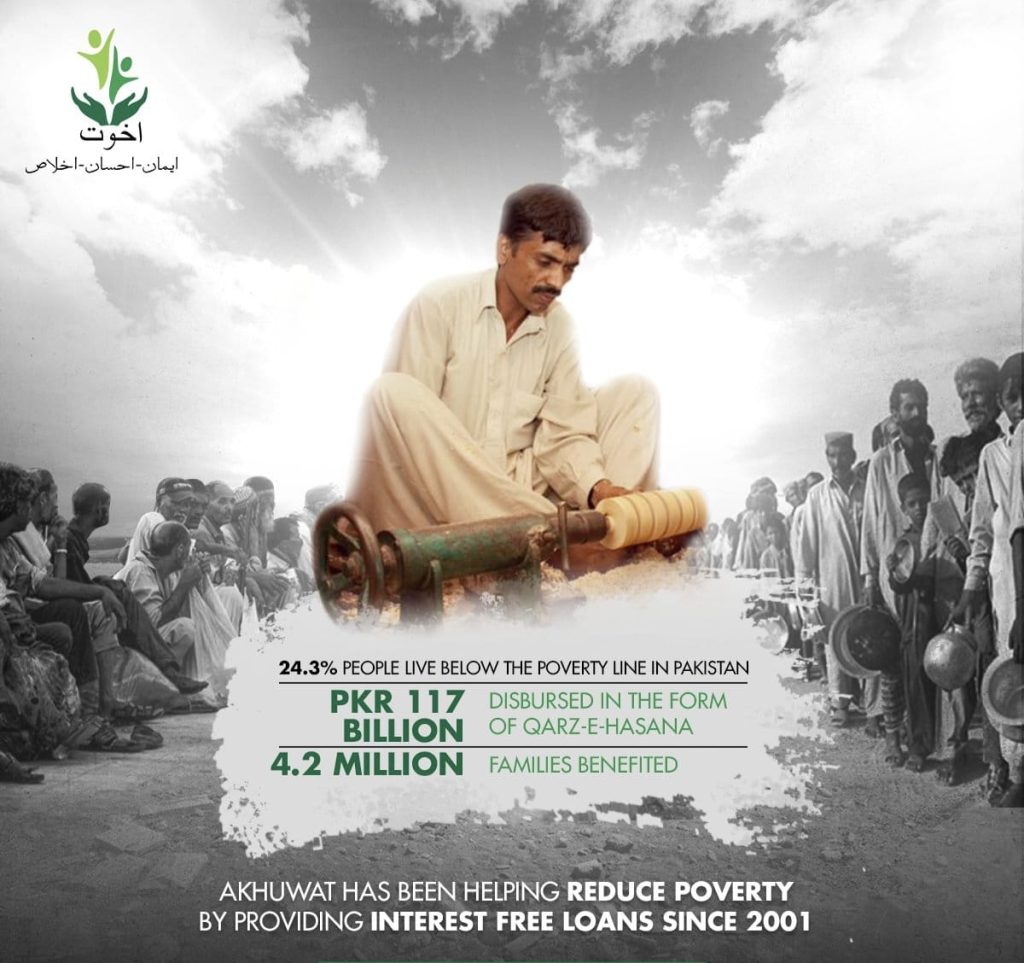

Akhuwat Foundation stands out as a unique loan provider in Pakistan, offering ethical, interest-free loans (Qarz-e-Hasna)

those in need. Unlike conventional banks, Akhuwat prioritizes social

welfare over profit. 03457220477

Akhuwat Foundation stands out as a unique loan provider in Pakistan, offering ethical, interest-free loans (Qarz-e-Hasna) designed to uplift those in need. Unlike conventional banks, Akhuwat prioritizes social welfare over profit.

Our Services

Akhuwat Business Loan

Applying for a business loan with Akhuwat is simple and can be done entirely online from the comfort of your office. Akhuwat’s business loans are designed to meet short-term financial needs, with quick approvals typically granted within hours. The application process requires minimal documentation, ensuring a smooth and hassle-free experience, allowing you to focus on your business without delays.

Akhuwat Home Loan

The Akhuwat Foundation in Pakistan offers home loans for purchasing, building, or renovating residential properties. If you require fast financial assistance, the Akhuwat Home Loan provides a streamlined application process, ensuring you receive the funds you need without any delays. This service is perfect for individuals seeking urgent financial support in Pakistan, allowing you to secure the necessary funds quickly and efficiently for your housing needs.

Akhuwat Personal Loan

The Akhuwat Foundation provides personal loans of up to Rs. 2.5 million, with the loan amount determined by factors such as your income, debt-to-income ratio, credit score, and employment status. To qualify, you must be between the ages of 24 and 60. You can easily track the status of your loan application through the Akhuwat Foundation’s website, providing you with real-time updates and transparency throughout the process.

AKHUWAT LOAN HELPLINE NUMBER 2025

Akhuwat Loan

If you are considering applying for a loan from the Akhuwat Foundation, you’re making a smart choice. Akhuwat offers interest-free loans (Qarz-e-Hasna) to help individuals meet their financial needs while improving their quality of

life. You can apply easily online, with loan options ranging from Rs. 500,000 to Rs. 50 million, all from the comfort of your home.

Akhuwat Loan Helpline 03460830970

Akhuwat Loan Scheme 2025 program is a key part of the foundation’s work to create positive change in Pakistan’s economy and society. This program offers interest-free loans, which is rare in the microfinance industry worldwide. It aims to help people like small business owners, craftsmen, farmers, and women by giving them the money they need to achieve their goals and improve their lives.

The Akhuwat Loan is different because it has no interest and is easy to get. The foundation relies on trust and community involvement, working with local leaders and groups to give out loans. This model makes the loans more than just money transactions; they also build trust and support in the community, promoting a culture of giving back.

How to Apply for Loan?

Contact the Akhuwat Head Office Contact Number. when you make a call to Akhuwat Helpline Number then officials will guide you or contact on whatsapp given button.

Akhuwat Student Loan

The Akhuwat Foundation offers student loan to make education more affordable and accessible. This program helps cover important costs like tuition fees, books, and study materials, making it easier for students to focus on their studies.

Adaptable and Convenient

To develop and sustain a social system based on mutual support where each individual lives a life full of respect and dignity.

Akhuwat Loan Contact Number 03457220477

Akhuwat Loan

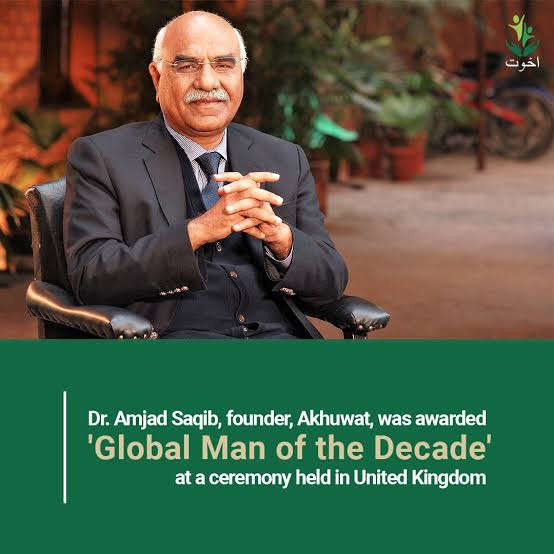

Progressing from a historical and philosophical discourse towards a pragmatic model of poverty alleviation, Akhuwat was founded by Dr. Amjad Saqib in 2001. Prior to establishing Akhuwat, he served in the Civil Services of Pakistan in the District Management Group (DMG).

While serving as the General Manager

While serving as the General Manager of the Punjab Rural Support Program (PRSP) he had witnessed the devastating impact of poverty and was committed to dedicate the rest of his life to alleviate the suffering of the poor. He once took his friends to visited a village, Jia Bagga ,to study the impact of intervention by PRSP. Dr. Kamran Shams and he had a conversation with a local woman, inquiring what has been the impact of the PKR 10,000 loan she took from the PRSP.

How to Apply for an Akhuwat Loan

Types of Loans Offered:

- Business Loans

- Education Loans

- Wedding Loans

- Health Loans

- Emergency Loans

- Apna Ghar Apne Chhat

- Personal Loan

- Car Loan

- Student Loan

- Home Loan

نوٹ:۔ پانچ لاکھ تک قرضے کی رجسٹریشن فیس 4,400 روپے ہے اور پانچ لاکھ سے زیادہ قرضے کی رجسٹریشن فیس 5,600 روپے ہے۔

| Loan Amount | Time Period | Monthly Installment |

|---|---|---|

| 50,000 | 01 YEAR | 4,170 EMI |

| 100,000 | 01 YEAR | 8,335 EMI |

| 500,000 | 05 YEARS | 8,335 EMI |

| 1,000,000 | 10 YEARS | 8,335 EMI |

| 1,500,000 | 10 YEARS | 12,500 EMI |

| 2,000,000 | 10 YEARS | 16,670 EMI |

| 3,000,000 | 10 YEARS | 25,000 EMI |

| 5,000,000 | 15 YEARS | 27,780 EMI |

How to Apply this Loan?

Applying for an Akhuwat loan is easy and inclusive. The process is designed to help people in Pakistan by reducing poverty and empowering individuals. If you want to apply for a loan to start a business, grow one, or meet personal financial needs, here is a simple guide to help you through the application process.

akhuwat loan

Akhuwat

Akhuwat loan apply

Akhuwat foundation

Akhuwat helpline

Step 1: Understand the Eligibility Criteria

Before applying, it’s important to understand the eligibility criteria set by Akhuwat. The foundation typically offers loans to:

- Individuals looking to start or expand a small business.

- People in need of financial assistance for education, healthcare, or improving living conditions.

- Applicants must show they need the loan and have a good plan to use it.

Akhuwat gives priority to people who are poor and may not have a bank account. Knowing this will help you check if you qualify and get ready to apply.

Step 2: Prepare Your Documentation

Akhuwat wants to make it easier for you to get a loan. You will need some documents for your loan application. This may include:

- A valid form of identification (such as a National ID card).

- Proof of residence or business location.

- A detailed business plan or description of how the loan will be used, demonstrating its viability and potential impact on your economic situation.

Make sure your documents are up-to-date and correct to prevent any delays in your application.

Step 3: Visit an Akhuwat Branch or Contact Point

Find the closest Akhuwat branch or contact point in your area. Akhuwat has many offices in Pakistan, working with local mosques, churches, and community centers. Visiting in person lets you get information, ask questions, and learn about the foundation’s values.

Step 4: Attend an Orientation Session

Akhuwat regularly holds sessions for people interested in applying for loans. These sessions give information about the loan process, repayment terms, and success stories of past recipients. Going to a session is a great chance to learn about the foundation’s mission and how it can help with your financial needs and goals.

Step 5: Submit Your Loan Application

Once you have all the required information and documents, you can submit your loan application. Akhuwat staff will help you with the process to make sure your paperwork is complete and accurately shows your needs and ability to repay.

Step 6: Participate in the Community Verification Process

Akhuwat involves the community in verifying loan applications. They may visit your home or business and talk to community members to confirm your need and ability for the loan. This shows the foundation’s focus on community support and shared responsibility.

Step 7: Loan Approval and Disbursement

After your loan application is verified, it will be reviewed for approval. If approved, you will receive the loan in a group setting, highlighting the community’s support for everyone’s success.

Step 8: Repayments

Akhuwat loans have a clear repayment schedule and usually don’t have interest. When you pay back your loan, you not only fulfill your commitment but also help support other people in need through a revolving fund.

Applying for an Akhuwat loan is not just about money. It’s a way to join a community that helps and supports each other. By following these steps and getting involved, applicants can get the help they need to create a better future.

Akhuwat Car Loan

Akhuwat Loan Whatsapp Helpline 03457220477

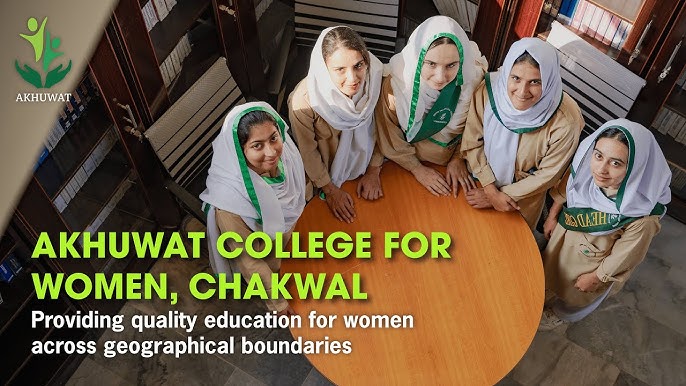

Akhuwat Education

Now is the time for Approve your Loan Easy and Fast with Live chat Akhuwat Loan Helpline Agent,

Social media

The Akhuwat Foundation offers car loans with interest rates beginning at just 1% per annum. With up to 100% on-road financing, they simplify the process of purchasing your dream car.

best loan scheme

loan apply online

personal loan on call

student loan assistance

call for business loan

online loan phone number

loan consultant Pakistan

Loan apply online

Akhuwat Foundation Loan

If you are considering applying for a loan from the Akhuwat Foundation, you’re making a smart choice. Akhuwat offers interest-free loans (Qarz-e-Hasna) to help individuals meet their financial needs while improving their quality of life. You can apply easily online, with loan options ranging from Rs. 500,000 to Rs. 50 million, all from the comfort of your home.

Akhuwat provides five types of loans to suit various needs: Personal Loans, Student Loans, Wedding Loans, Business Loans, and Car Loans. Their application process is simple and user-friendly, allowing you to access ethical, interest-free support.

get loan fast

quick loan Pakistan

urgent loan call now

instant approval loan

quick loan Pakistan

urgent loan call now

Microfinance Loans

Maximum Amount: PKR 1,500,000

These loans designed for small businesses, including retail, agriculture, and manufacturing. They help entrepreneurs to start or expand their ventures. Housing Loans

Maximum Amount: PKR 2,500,000

Akhuwat offers housing loans to individuals who need financial support to build or repair their homes. These loans meant to provide shelter to low-income families.

Education Loans

Maximum Amount: PKR 5,000,000

These loans offered to students from

underprivileged backgrounds who need financial assistance for their education. Covering tuition fees, books, and other educational expenses.

Healthcare Loans

Maximum Amount: PKR 7,000,000

Akhuwat provides healthcare loans to cover medical treatment and expenses for individuals who cannot afford necessary healthcare services.

Agricultural Loans

Maximum Amount: PKR 50,000,000

These loans aimed at farmers who need capital for purchasing seeds, fertilizers, or other farming equipment to improve agricultural productivity.

PIERRE OMIDYAR

At Akhuwat, we believe in the power of informed lending. By leveraging data-driven insights, we ensure that every loan—whether for microfinance, education, or healthcare—drives meaningful change and creates lasting opportunities for growth.